UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-2 |

A10 NETWORKS, INC. |

(Name of Registrant as Specified In Its Charter) |

Payment of Filing Fee (Check all boxes that apply): | ||||||||||||||||||||||||||||||||||||||||||

☒ | No fee required. | |||||

☐ | Fee paid previously with preliminary materials. | |||||

☐ | Fee computed in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||||

A10 NETWORKS, INC.

2300 ORCHARD PARKWAY

SAN JOSE, CALIFORNIA 95131

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 10 a.m. Pacific Time on Wednesday, April 26, 2023Thursday, May 9, 2024

Dear Stockholders of A10 Networks, Inc.:

The 20232024 Annual Meeting of stockholders (the “Annual Meeting”) of A10 Networks, Inc., a Delaware corporation, will be held on Wednesday, April 26, 2023Thursday, May 9, 2024 at 10:00 a.m. Pacific Time, at 2300 Orchard Parkway, San Jose, California, for the following purposes, as more fully described in the accompanying proxy statement:

| 1. | To elect each of the director nominees named in the accompanying proxy statement, to serve until the |

| 2. | To approve, on an advisory and non-binding basis, the compensation of our named executive officers as described in the accompanying proxy statement; |

| 3. | To ratify the appointment of |

| 4. |

| To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

Our board of directors has fixed the close of business on February 28, 2023March 15, 2024 as the record date for the Annual Meeting. Only stockholders of record on February 28, 2023March 15, 2024 are entitled to notice of and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement. If you plan on attending the Annual Meeting as a stockholder, please follow the instructions on page 5245 of the proxy statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDERS MEETING TO BE HELD ON APRIL 26, 2023MAY 9, 2024 – THE PROXY STATEMENT AND ANNUAL REPORT TO STOCKHOLDERS ARE AVAILABLE AT http://www.proxyvote.com. We are mailing a notice of availability over the Internet of the proxy materials which contains instructions on how to access our proxy materials on the Internet, as well as instructions on obtaining a paper copy.

Whether or not you plan to attend the Annual Meeting, we urge you to submit your vote via the Internet, telephone or mail.

We appreciate your continued support of A10 Networks, Inc. and look forward to either greeting you personally at the Annual Meeting or receiving your proxy.

| | | By order of the Board of Directors, | |

| | | Dhrupad Trivedi | |

| | | President, Chief Executive Officer and Chairperson | |

| | | San Jose, California | |

March | | |

i

A10 NETWORKS, INC.

FOR 2023 Annual Meeting2024 ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 10:00 a.m. Pacific Time on Wednesday, April 26, 2023Thursday, May 9, 2024

This proxy statement and the form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 20232024 Annual Meeting of stockholders of A10 Networks, Inc., a Delaware corporation (the “Company”), and any postponements, adjournments or continuations thereof (the “Annual Meeting”). The Annual Meeting will be held on Wednesday, April 26, 2023Thursday, May 9, 2024 at 10:00 a.m. Pacific Time, at 2300 Orchard Parkway, San Jose, California. The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this proxy statement and our annual report is first being mailed on or about March 15, 202327, 2024 to all stockholders entitled to vote at the Annual Meeting.

Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

1

Our business affairs are managed under the direction of our board of directors, which is currently composed of five members and has the following characteristics:

| • | Director Independence. 4 of the 5 individuals currently serving as directors are independent within the meaning of the listing standards of the New York Stock Exchange. |

| • |

| • | Director Tenure. Our directors are not long |

| • | Director Age. Average age of our directors is approximately |

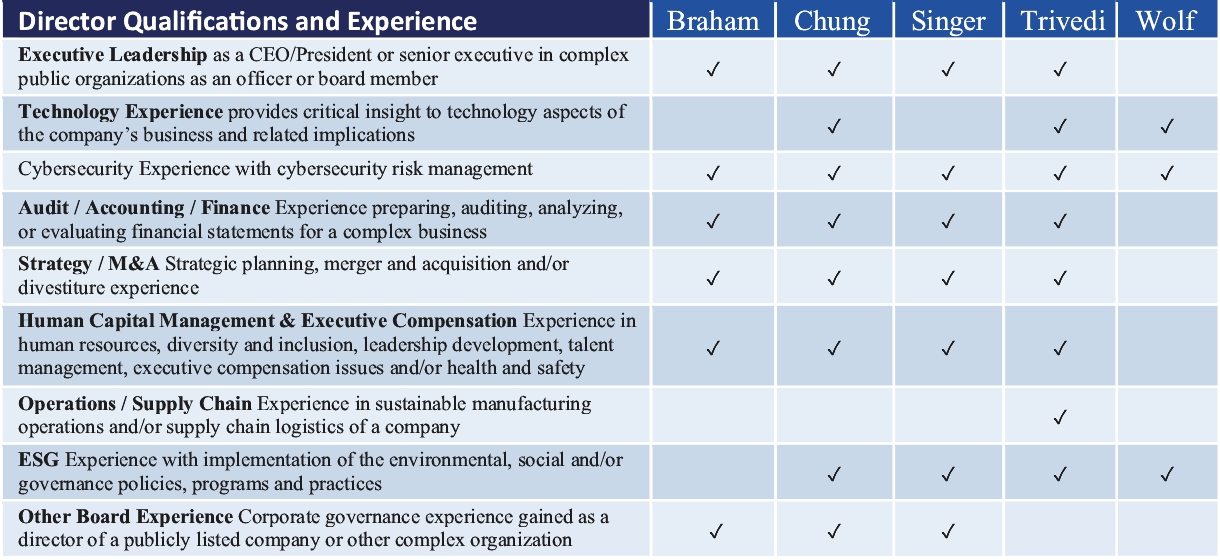

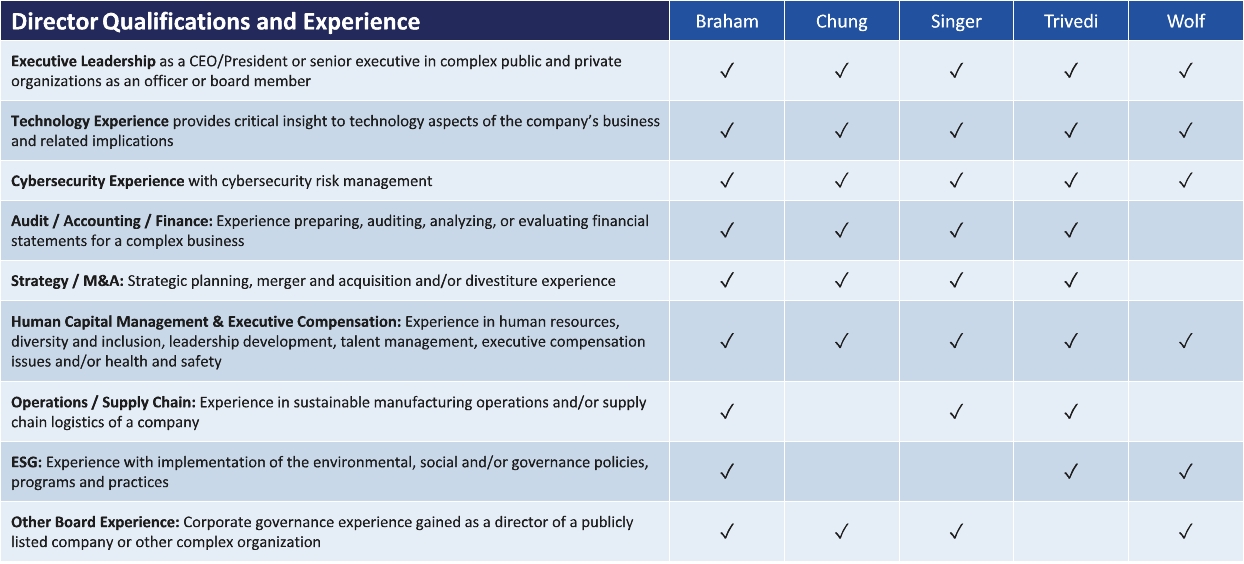

| • | Director Skills. Our directors have the following diverse experiences and perspectives in areas that we believe are critical to the success of our business and to the creation of sustainable stockholder value: |

| • | Director Diversity. 60% of our directors currently self-identify as being from one or multiple diverse groups, including gender. |

The following table sets forth the names, ages and certain other information for each of our directors and director nominees as of March 15, 2023:27, 2024:

Name | | Age | | Director Since | | Position | | Age | | Director Since | | Position | ||||||

Dhrupad Trivedi | | 56 | | 2019 | | President, Chief Executive Officer and Chairperson | | 57 | | 2019 | | President, Chief Executive Officer and Chairperson | ||||||

Tor R. Braham | | 65 | | 2018 | | Director | | 66 | | 2018 | | Director | ||||||

Peter Y. Chung(1)(2)(3) | | 55 | | 2013 | | Director | | 56 | | 2013 | | Director | ||||||

Eric Singer(1)(2)(3) | | 49 | | 2019 | | Director | | 50 | | 2019 | | Director | ||||||

Dana Wolf | | 48 | | 2022 | | Director | | 49 | | 2022 | | Director | ||||||

| (1) | Member of our audit committee |

| (2) | Member of our compensation committee |

| (3) | Member of our nominating and corporate governance committee |

2

Dhrupad Trivedi joined A10 Networks, Inc. in December 2019 as president and chief executive officer. Mr. Trivedi was also appointed as a member of our board of directors in December 2019 and as Chairperson of the board in September 2020. From March 2013 to November 2019, Mr. Trivedi served as President, Network Solutions – Industrial IT/IOT and Cybersecurity at Belden Inc. (NYSE: BDC), a manufacturer of networking, connectivity, and cable products, andwhere he also served as a corporate vice president from January 2010 to March 2013. Prior to this, he held multiple general management and corporate development roles at JDS Uniphase Corporation. Mr. Trivedi holds a

Ph.D. in electrical engineering from the University of Massachusetts, Amherst, a master’s degree in electrical engineering from the University of Alabama and an MBA in finance from Duke University. Mr. Trivedi brings global leadership experience across multiple businesses and is passionate about driving leading technology businesses to win by creating value for customers.

Tor R. Braham has served as a member of our board of directors since March 2018. He is currently also a director of Viavi Solutions Inc. (Nasdaq: VIAV), a network and service enablement and optical coatings company. Mr. Braham is also Of Counsel to the law firm of King, Holmes, Paterno and Soriano, LLP. He previously served as a member of the board of directors of Yahoo! Inc., a provider of web services from April 2016 to June 2017, Altaba, Inc., a publicly traded investment company from June 2017 to December 2021, NetApp, Inc. (Nasdaq: NTAP), a computer storage and data management company, from September 2013 to March 2016, Sigma Designs, Inc. (“Sigma”), an integrated circuit provider for the home entertainment market, from June 2014 to August 2016, Live Oak Acquisition Corp (NYSE: DNMR) from February 2020 to December 2020, and Live Oak Acquisition Corp II (NYSE: LOKB), from December 2020 to October 2021. Mr. Braham served as Managing Director and Global Head of Technology Mergers and Acquisitions for Deutsche Bank Securities Inc., an investment bank, from 2004 until November 2012. From 2000 to 2004, he served as Managing Director and Co-Head of West Coast U.S. Technology, Mergers and Acquisitions for Credit Suisse First Boston, an investment bank. Prior to that role, Mr. Braham served as an investment banker with Warburg Dillon Read LLC and as an attorney at Wilson Sonsini Goodrich & Rosati. Mr. Braham has specific attributes that qualify him to serve as a member of our board of directors, including his extensive financial experience and knowledge of the technology industry gained through his service as an investment banker and lawyer to technology companies, as well as his service on public and private company boards.

Peter Y. Chung has served as a member of our board of directors since June 2013. Mr. Chung is a Managing Director and Chief Executive Officer of Summit Partners, L.P., where he has been employed since 1994. He is currently a director of MACOM Technology Solutions Holdings, Inc. (Nasdaq: MTSI) as well as several privately-held companies. Mr. Chung previously served as a member of the board of directors of Acacia Communications, Inc. Mr. Chung has an M.B.A. from the Stanford University Graduate School of Business and an A.B. in Economics from Harvard University. Mr. Chung has specific attributes that qualify him to serve as a member of our board of directors, including his experience in investment banking, private equity and venture capital investing and in the communications technology sector, as well as his prior service on public and private company boards.

Eric Singer has served as a member of our board of directors since July 2019 and as our lead independent director since September 2021. Since January 2023, Mr. Singer has served as the Chief Executive Officer of Immersion Corporation (Nasdaq: IMMR), a developer and licensor of touch feedback technology, since January 2023, as a member of their board of directors since March 2020, and as executive chairman since August 2020. Mr. Singer ishas served as a member of the board of directors of Universal Electronics (NASDAQ: UEIC) since December 2023. Mr. Singer was the founder and Managing Member of VIEX Capital Advisors, LLC, a securities investment firm.firm from 2014 until December 2022. In addition to a long track record as a successful investor in technology companies, Mr. Singer has substantial experience serving on public boards, and in assisting them in creating and expanding shareholder value. Mr. Singer previously served on the boards of directors of Quantum Corporation (Nasdaq: QMCO), a video data storage and management company, Numerex Corp., a provider of managed machine-to-machine enterprise solutions enabling the Internet of Things, RhythmOne plc and YuMe, Inc., each a provider of brand video advertising software and audience data, Support.com, Inc., a provider of tech support and support center services, Meru Networks, Inc., a Wi-Fi network solutions company, PLX Technology, Inc., a PCI Express and ethernet semiconductor company, and Sigma, among other companies. Mr. Singer has a B.A. from Brandeis University. Mr. Singer has specific attributes that qualify him to serve as a member of our board of directors, including his extensive financial and operating experience and knowledge of the technology industry gained through his service on numerous public and private company boards.

3

Dana Wolf has served as a member of our board of directors since June 2022. Ms. Wolf is currently the Chief Executive Officer / co-founder and member of the board of directors of YeshID, an identity and access management provider. From August 2017 to November 2021 she served as Senior Vice President of Product & Marketing at Fastly Inc. (NYSE: FSLV), a global edge cloud network provider. From August 2013 to August 2017, she was the Head of Product for the cloud security product lines at OpenDNS, Inc. (acquired by Cisco Systems, Inc. (Nasdaq: CSCO)), a company providing domain name system resolution services. Ms. Wolf has over 18 years of experience in the security space, holding both product and engineering leadership roles at both Rapid7 Inc. (Nasdaq: RPD), a cyber security analytics and automation services company, and RSA Security LLC, a computer and network security company with a focus on protecting and

managing online identities and digital assets. Ms. Wolf holds a B.A. from Lawrence University in Mathematics, Computer Science and Theatre and an M.B.A. (High Tech) from Northeastern University. Ms. Wolf has specific attributes that qualify her to serve as a member of our board of directors, including her extensive experience in the cyber security industry and cloud-based businesses.

Our common stock is listed on the New York Stock Exchange. Under the listing standards of the New York Stock Exchange, independent directors must comprise a majority of a listed company’s board of directors. In addition, the listing standards of the New York Stock Exchange require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent. Under the listing standards of the New York Stock Exchange, a director will only qualify as an “independent director” if, in the opinion of that listed company’s board of directors, that director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the listing standards of the New York Stock Exchange. In addition, compensation committee members must also satisfy the independence criteria set forth under the listing standards of the New York Stock Exchange.

Our board of directors has undertaken a review of the independence of each director. Based on information provided by each director concerning his or her background, employment and affiliations, our board of directors has determined that all of our directors other than Mr. Trivedi, our chief executive officer, are “independent” as that term is defined under the listing standards of the New York Stock Exchange and do not have any relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our board of directors considered the current and prior relationships that each director has with our company and all other facts and circumstances our board of directors deemed relevant in determining his or her independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving him or her described in the section titled “Related Person Transactions.”

The Boardboard is committed to strong, independent Boardboard leadership and oversight of management’s performance. The Board believes that whether to have the same person occupy the offices of Chairperson of the Boardboard and Chief Executive Officer should be decided by the Board,board, from time to time, in its business judgment after considering relevant factors, including the specific needs of the business and what is in the best interests of our stockholders. If the Chairperson is an employee, the Boardboard may appoint a lead independent director to help ensure robust independent leadership on the Board.board.

The Chairperson of the Boardboard has the powers and duties customarily and usually associated with the office of the chairperson of the board, including setting the schedule and agenda for Boardboard meetings and presiding at meetings of the Boardboard and meetings of our stockholders, unless a Chairperson of a stockholder meeting is otherwise appointed by the Board.board. The Chairperson also has the authority to call special meetings of our stockholders. If our Chairperson is an independent, non-employee director, the Chairperson has the responsibilities of the lead independent director.

Mr. Trivedi currently serves as both Chairperson of our board of directors and our Chief Executive Officer. Our board believes that the current board leadership structure provides effective independent oversight of management while allowing our board and management to benefit from Mr. Trivedi’s leadership and years of experience as an

4

executive in multiple global high technology industries including networking, cloud, IOT and cybersecurity. Mr. Trivedi is best positioned to identify strategic priorities, lead critical discussion and execute our strategy and business plans. Mr. Trivedi possesses detailed in-depth knowledge of the issues, opportunities, and challenges facing our company.

Our lead independent director has the responsibility to schedule and prepare agendas for meetings of the outside directors. The lead independent director may communicate with our Chief Executive Officer, disseminate information to the rest of the Boardboard in a timely manner, raise issues with management on behalf of the outside directors when appropriate, and facilitate communications between management and the outside directors. In addition, the lead

independent director may have other responsibilities, including calling meetings of outside directors when necessary and appropriate, being available, when appropriate, for consultation and direct communication with our stockholders, building a productive relationship between the Boardboard and the Chief Executive Officer, ensuring the Boardboard fulfills its oversight responsibilities in our strategy, risk oversight and succession planning, and performing such other duties as the Boardboard may from time to time designate.

Mr. Singer serves as our lead independent director. In this role, Mr. Singer presides over periodic meetings of our independent directors, serves as a liaison between our chairpersonChairperson of the board of directors and the independent directors, and performs such additional duties as our board of directors may otherwise determine and delegate.

During our fiscal year ended December 31, 2022,2023, the board of directors held five (5)twelve (12) meetings (including regularly scheduled and special meetings) and acted by written consent five (5)seven (7) times. Throughout the year, directors met frequently to discuss our operations, the impact of Covid-19 on our business, strategic matters and other business. In many instances, these meetings resulted in formal board action approved by unanimous written consent. In other instances, these meetings resulted in our board of directors providing input to our management team throughout the year. No director attended fewer than 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of our board of directors on which he or she served during the periods that he or she served.

Although we do not have a formal policy regarding attendance by members of our board of directors at annual meetings of stockholders, we encourage, but do not require, our directors to attend. All of our continuing directors attended our 20222023 annual meeting of stockholders. Our board of directors has established three standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each of these committees is described below. Members will serve on these committees until their resignation or until as otherwise determined by our board of directors.

Audit Committee

The audit committee is currently comprised of Messrs. Braham, Chung and Singer. Mr. Braham is the chair of the audit committee. Our board of directors has determined that each of the members of this committee satisfies the requirements for independence and financial literacy under the applicable rules and regulations of the New York Stock Exchange and the SEC. Our board of directors has also determined that Mr. Braham and Mr. Chung each qualify as an “audit committee financial expert” as defined in the SEC rules and each satisfy the financial sophistication requirements of the New York Stock Exchange.

The audit committee is responsible for, among other things:

selecting and hiring our registered public accounting firm;

evaluating the performance and independence of our registered public accounting firm;

approving the audit and pre-approving any non-audit services to be performed by our registered public accounting firm;

reviewing our financial statements and related disclosures and reviewing our critical accounting policies and practices;

reviewing the adequacy and effectiveness of our internal control policies and procedures and our disclosure controls and procedures;

5

overseeing procedures for the treatment of complaints on accounting, internal accounting controls, or audit matters;

overseeing, monitoring and coordinating with regard to risk management, including those relating to enterprise risk management (ERM) and cybersecurity;

reviewing and discussing with management and the independent registered public accounting firm the results of our annual audit, our quarterly financial statements, and our publicly filed reports;

reviewing and approving in advance any proposed related person transactions; and

preparing the audit committee report to be included in our annual proxy statement as required by the SEC.

The audit committee operates under a written charter that satisfies the applicable standards of the SEC and the New York Stock Exchange. A copy of the charter of the audit committee is available on our website at http:https://investors.a10networks.com.investors.a10networks.com/. During 2022,2023, the audit committee held five (5) meetings.four (4) meetings and acted by written consent two (2) times.

Compensation Committee

The compensation committee currently consists of Messrs. Braham, Chung and Singer.Singer and Ms. Wolf (since October 2023). Mr. Chung is the chair of the compensation committee. Our board of directors has determined that each member of this committee is independent under the applicable rules and regulations of the New York Stock Exchange and the SEC, a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, and an outside director, as defined under Section 162(m) of the Internal Revenue Code of 1986, as amended.

The compensation committee is responsible for, among other things:

reviewing and approving our Chief Executive Officer’s and other executive officers’ annual base salaries, incentive compensation plans, including the specific goals and amounts, equity compensation, employment agreements, severance arrangements and change in control agreements, and any other benefits, compensation or arrangements;

evaluating director compensation and making recommendations to the board of directors regarding such compensation;

administering our equity compensation plans;

overseeing our overall compensation philosophy, compensation plans, and benefits programs; and

preparing the compensation committee report to be included in our form 10-K or annual proxy statement as required by the SEC.

The compensation committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the New York Stock Exchange. A copy of the charter of the compensation committee is available on our website at http:https://investors.a10networks.com.investors.a10networks.com/. During 2022,2023, the compensation committee held four (4) meetings and acted by written consent five (5)nine (9) times.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee currently consists of Messrs. Chung and Singer. Mr. Singer is the chair of the nominating and corporate governance committee. Our board of directors has determined that each member of this committee meets the requirements for independence under the rules of the New York Stock Exchange.

The nominating and corporate governance committee is responsible for, among other things:

evaluating and making recommendations regarding the composition, organization, and governance of our board of directors and its committees;

evaluating and making recommendations regarding the development, oversight, and implementation of the Company’s Environmental, Social, and Governance (“ESG”) policies, programs, and practices;

evaluating and making recommendations regarding the policies, programs, practices, and reports concerning ESG, including sustainability, environmental protection, community and social responsibility, and human rights;

6

evaluating and making recommendations regarding the creation of additional committees or the change in mandate or dissolution of committees;

reviewing and making recommendations with regard to our corporate governance guidelines and compliance with laws and regulations; and

reviewing actual and potential conflicts of interest of our directors and corporate officers, other than related person transactions reviewed by the audit committee and approving or prohibiting any involvement of such persons in matters that may involve a conflict of interest.

The nominating and corporate governance committee operates under a written charter that satisfies the applicable listing standards of the New York Stock Exchange. A copy of the charter of the nominating and corporate

governance committee is available on our website at http:https://investors.a10networks.com.investors.a10networks.com/. During 2022,2023, the nominating and corporate governance committee held four (4) meetings and acted by written consent three (3) times.meetings.

Messrs. Braham, Chung and Singer and Ms. Wolf are the current members of our compensation committee. None of the members of our compensation committee is or has been one of our officers or employees. None of our executive officers currently serves, or in the past year has served, as a member of the compensation committee or director (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of any entity that has one or more executive officers serving on our compensation committee or our board of directors.

Our nominating and corporate governance committee uses a variety of methods for identifying and evaluating director nominees. In its evaluation of director candidates, our nominating and corporate governance committee will consider the current size and composition of our board of directors and the needs of our board of directors and the respective committees of our board of directors. Some of the qualifications that our nominating and corporate governance committee considers include, without limitation, issues of character, integrity, judgment, diversity (including, but not limited to, diversity of gender, ethnicity, race, international background and life experience), independence, area of expertise, corporate experience, length of service, potential conflicts of interest and other commitments. Nominees must also have the ability to offer advice and guidance to our Chief Executive Officer based on past experience in positions with a high degree of responsibility and be leaders in the companies or institutions with which they are affiliated. Director candidates must have sufficient time available in the judgment of our nominating and corporate governance committee to perform all board of director and committee responsibilities. Members of our board of directors are expected to prepare for, attend, and participate in all board of director and applicable committee meetings. Other than the foregoing, there are no stated minimum criteria for director nominees, although our nominating and corporate governance committee may also consider such other factors as it may deem, from time to time, are in our and our stockholders’ best interests.

Although our board of directors does not maintain a specific policy with respect to board diversity, our board of directors believes that our board should be a diverse body, and our nominating and corporate governance committee considers a broad range of backgrounds and experiences. In making determinations regarding nominations of directors, our nominating and corporate governance committee may taketakes into account the benefits of diverse viewpoints. Our nominating and corporate governance committee also considers these and other factors as it oversees the annual board of director and committee evaluations. After completing its review and evaluation of director candidates, our nominating and corporate governance committee recommends to our full board of directors the director nominees for selection. The Company is committed to diversity at all levels, including with our directors, and our nominating and corporate governance committee is committed to considering diversity, including gender diversity, in identifying future candidates for nomination to the board. Sixty percent of our directors self-identify as being from one or multiple diverse groups.

Our nominating and corporate governance committee will consider candidates for director recommended by stockholders so long as such recommendations comply with our amended and restated certificate of incorporation currently in effect and amended and restated bylaws and applicable laws, rules and regulations, including those promulgated by the

7

SEC. The nominating and corporate governance committee will evaluate such recommendations in accordance with its charter, our amended and restated bylaws, our policies and procedures for director candidates, as well as the regular director nominee criteria described above. This process is designed to ensure that our board of directors includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to our business. Eligible stockholders wishing to recommend a candidate for nomination should contact our Secretary in writing. Such recommendations must include, amongst other things provided in our Bylawsbylaws and under Section 14 of the Exchange Act, information about the candidate, evidence of the recommending stockholder’s ownership of our common stock and a signed letter from the candidate confirming willingness to serve on our board of directors. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors.

Any nomination should be sent in writing to our Secretary at A10 Networks, Inc., 2300 Orchard Parkway, San Jose, CA 95131. If we hold the 20242025 annual meeting of stockholders no more than 30 days before or after the one-year anniversary of this year’s Annual Meeting, then our Secretary must receive the written nomination;

no earlier than December 31, 2023;January 11, 2025; and

no later than the close of business on January 30, 2024.February 10, 2025.

If we hold the 20242025 annual meeting more than 30 days before or after the one-year anniversary of this year’s Annual Meeting, then our Secretary must receive the written nomination no earlier than the close of business on the 120th120th day before the actual date of the 20242025 annual meeting and no later than the close of business on the later of the following two dates:

| • | the 90th day prior to the |

| • | the 10th day following the day on which we first announce publicly the date of the |

In addition, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934 no later than February 26, 2024.March 10, 2025.

Interested parties wishing to communicate with our board of directors or with an individual member or members of our board of directors may do so by writing to our board of directors or to the particular member or members of our board of directors, and mailing the correspondence to our General Counsel at A10 Networks, Inc., 2300 Orchard Parkway, San Jose, CA 95131, Attn: General Counsel. Each communication should set forth (i) the name and address of the stockholder, as it appears on our books, and if the shares of our common stock are held by a nominee, the name and address of the beneficial owner of such shares, and (ii) the number of shares of our common stock that are owned of record by the record holder and beneficially by the beneficial owner.

Our General Counsel, in consultation with appropriate members of our board of directors as necessary, will review all incoming communications and, if appropriate, forward such communications to the member or members of our board of directors to whom such communications were directed, or if none is specified, to the Chairperson of our board of directors.

Our board of directors has adopted Corporate Governance Guidelines that address items such as the qualifications and responsibilities of our directors and director candidates and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers. The full text of our Corporate Governance Guidelines and our Code of Business Conduct and Ethics is posted on the Corporate Governance portion of our website under Governance Documents at http:https://investors.a10networks.com. We will post amendments to our Code of Business Conduct and Ethics or waivers of our Code of Business Conduct and Ethics for directors and executive officers on the same website.

We maintain an open and collaborative dialogue with our stockholders. Our relationship with our shareholders, the owners of our Company, is a vital part of our success and our executive leadership team believes that active engagement with our investors is an important source of strategic insight. Our stockholders’ views are shared with

8

our Board, and integrated in discussions related to our strategy, operational performance, financial results, governance, compensation, and related matters. Direct and open stockholder engagement drives increased corporate accountability, improves decision making, and ultimately creates long-term value. Our management team provides regular updates to our Board regarding feedback that is received from those that own our shares.

During 2023, we conducted an extensive stockholder outreach effort which included reaching out to stockholders representing over 30% of our outstanding shares, including in person meetings, one-on-one calls or video conferences with approximately 40% of our top-25 largest stockholders to solicit their feedback and hear their views on the Company’s practices and policies as we evolve. Our Chief Executive Officer and Chief Financial Officer participated in these conversations. In addition to these conversations, we maintain ongoing dialogue with many of our investors through our investor relations program and have increased our effort to engage with stewardship and governance contacts throughout the year.

Hedging and Pledging

Pursuant to our Insider Trading Policy, all employees (including directors) are prohibited from engaging in transactions in publicly traded options and other derivative securities with respect to our common stock, including any hedging or similar transaction designed to decrease the risks associated with holding company securities. Our directors and named executive officers are also prohibited from pledging company securities as collateral or holding company securities in a margin account.

Clawback Policy

Our Executive Compensation Recoupment Policy provides for the recoupment of excess incentive compensation paid to executive officers, including the named executive officers, in the event of an accounting restatement due to material noncompliance with financial reporting requirements in accordance with New York Stock Exchange listing standards and Exchange Act Rule 10D-1.

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance, and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the company faces, while our

board of directors, as a whole and assisted by its committees, has responsibility for the oversight of risk management. In its risk oversight role, our board of directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are appropriate and functioning as designed.

Our board of directors believes that open communication between management and our board of directors is essential for effective risk management and oversight. Our board of directors meets with our Chief Executive Officer and other members of the senior management team at quarterly meetings of our board of directors, where, among other topics, they discuss strategy and risks facing the company, as well as at such other times as they deemed appropriate.

While our board of directors is ultimately responsible for risk oversight, our board committees assist our board of directors in fulfilling its oversight responsibilities in certain areas of risk. Our audit committee assists our board of directors in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting, disclosure controls and procedures, legal and regulatory compliance and cybersecurity, and discusses with management and the independent auditor guidelines and policies with respect to risk assessment and risk management. Our audit committee also reviews our major financial risk exposures and the steps management has taken to monitor and control these exposures. Our audit committee also monitors certain key risks on a regular basis throughout the fiscal year, such as risks associated with internal control over financial reporting and liquidity risk. Our nominating and corporate governance committee assists our board of directors in fulfilling its oversight responsibilities with respect to the management of risk associated with board organization, membership and structure, and corporate governance. Our compensation committee assesses risks created by the incentives inherent in our compensation policies. Finally, our full board of directors reviews strategic and operational risk in the context of reports from the management team, receives reports on all significant committee activities at each regular meeting, and evaluates the risks inherent in significant transactions.

9

Cybersecurity

Protecting the privacy and integrity of information and preventing cyber-crimes is a key focus of the Company. A10 is committed to providing networking solutions that enable next-generation networks focused on reliability, availability, scalability and cybersecurity. As cyber-attacks increase in volume and complexity, we integrate security as a key attribute in our solutions that further enable our customers to continue to adapt to market trends in cloud, internet of things and the ever increasingever-increasing need for more data, building upon our strong global footprint and leadership in application and network infrastructure.

Our board of directors, is responsibleexecutive management, and audit committee are actively engaged in the oversight of IT risk management, including cybersecurity risk. Executive management and the audit committee share responsibility for overseeing our risk exposure to information security, cybersecurity, and data protection, strategy. The Audit Committee reviewsas well as the steps management has taken to monitor and control such exposure. Our board of directors, executive management, and the audit committee receive quarterly reports on data security mattersIT controls and information security. Additionally, on at least an annual basis, our audit committee reviews and discusses with management our policies and programs with respect to the oversight of IT risk and cybersecurity threats.

Oversight for assessing and managing cybersecurity risk is performed by our IT cybersecurity team, with additional oversight performed by our human resources, internal audit and legal departments. Our executive management is briefed at least quarterly by these teams. Members of the board of directors, audit committee, and executive management are also encouraged to regularly engage in ad hoc conversations with management on cybersecurity-related news events and discuss any risk exposure from our General Counsel, the head of Information Security and internal audit. We also have engaged an independent and national cybersecurity firmupdates to analyze and help us enhance our cybersecurity risk management and strategy policiesprograms.

Our board of directors, executive management, and procedures to further reduce riskaudit committee are notified of any significant cybersecurity incidents through an escalation process that is established in our incident response plan and enable secure growth.incorporated into our disclosure controls and procedures. Additionally, we maintain a third-party vendor relationship that is available for on-demand incident response and investigation, as needed.

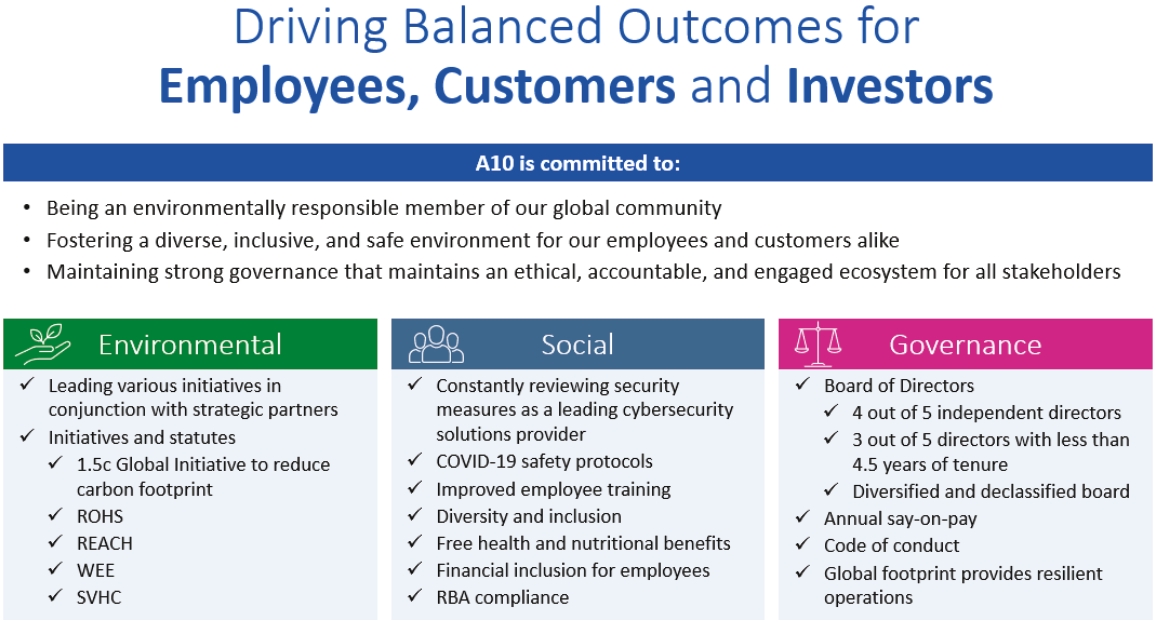

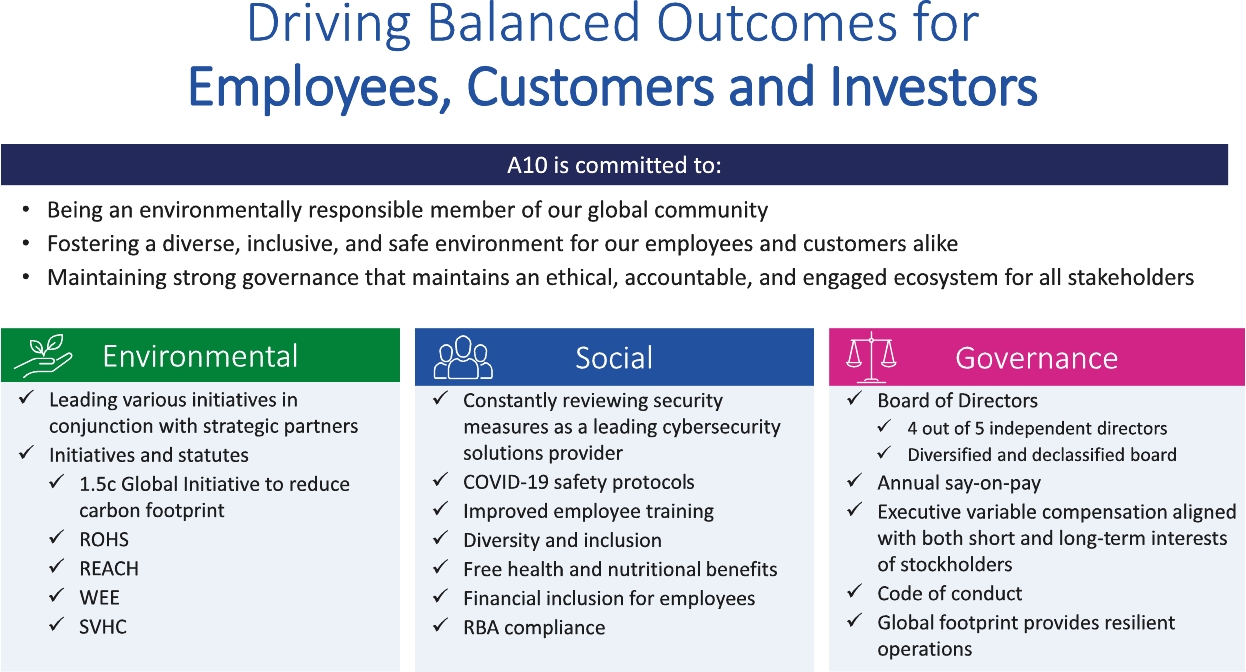

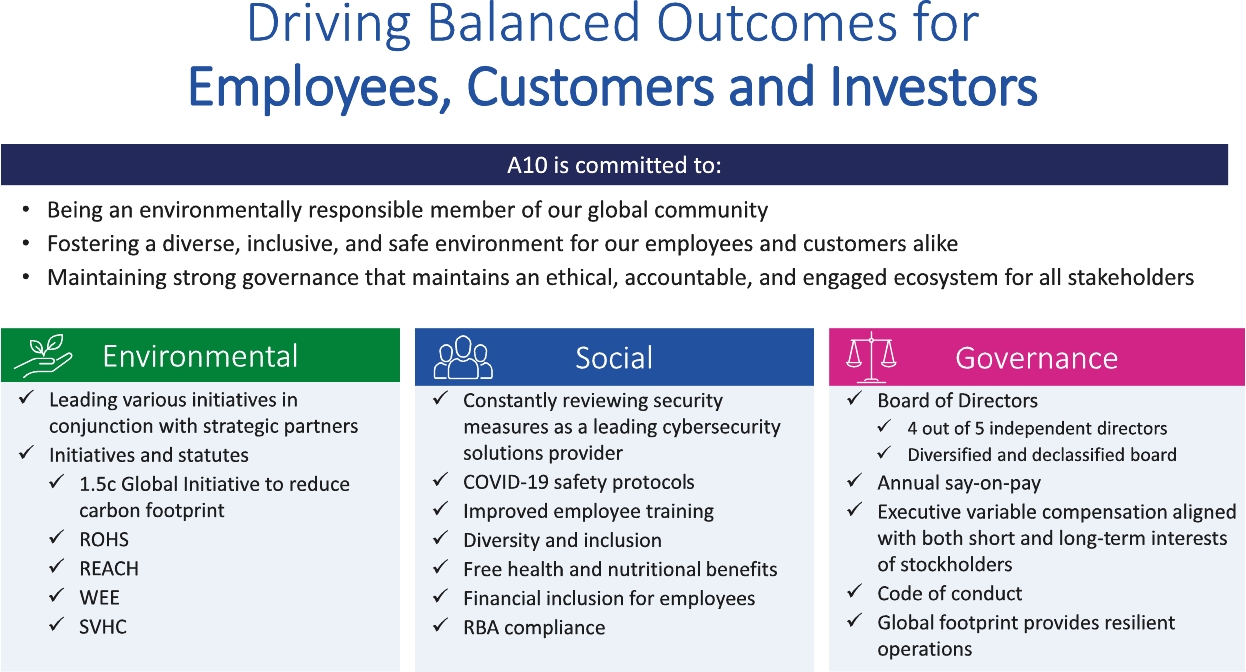

Corporate Social Responsibility

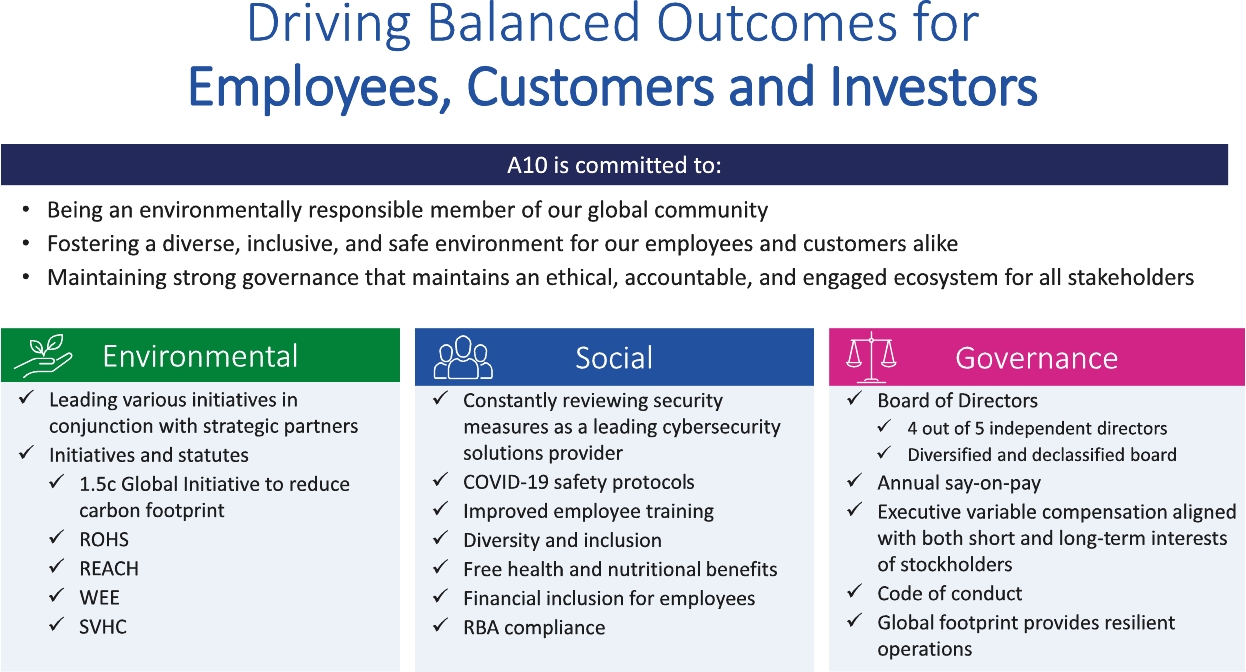

We are committed to maintaining the highest standards of ethics and corporate governance, and to fostering a diverse and inclusive workforce. We believe these practices will deliver the highest value for our employees, customers, partners and shareholders. Our global footprint provides an additional level of sustainability for business performance, and we carry through this responsibility across all our global locations. For this reason, we have an ESG policy to ensure that our Company is working towards continuing to a sustainable future in the following areas:

10

Environment

We are committed to business practices that preserve the environment upon which our society and economy depend. We are committed to meeting or exceeding all legal and compliance guidelines for our people, products, and operations. In addition, we strive to deliver products and services that minimize thenegative impact to the environment throughout our value chain.

We have adopted an Environmental Sustainability Policy. See at https://investors.a10networks.com/corporate-responsibility/.

We continue to evaluate environmental initiatives to further develop the Company’s policy and objectives. One such initiative is a sustainability project for reducing carbon emissions. We have engaged with a sustainability expert and set a baseline target year in 2019 for a 10-year carbon reduction plan. The strategy for this project is aligned with the 1.5°1.5"C initiative scope protocols.

Our corporate headquarters in San Jose, California is compliant with the California Building Energy Efficiency Standards - Title 24 to reduce wasteful and unnecessary energy consumption. We have planned for greater use of renewable energy in partnership with the local utility, PG&E. At our headquarters, we offer EV charging stations to our employees and visitors, and where applicable according to local requirements, we offer recycling and properly dispose of e-waste,

Under our Conflict Minerals Supply Chain Policy, we expect our suppliers to comply with our policy on responsible sourcing of minerals from conflict-affected and high-risk areas and to cooperate with our diligence inquiries and requests for information and certification as may be required to comply with reporting and disclosure obligations, and to not knowingly contribute to local conflict or human rights abuses.

Social

We believe in fostering a diverse and inclusive environment for employees, as well as encouraging diversity and inclusion within the customer and partner ecosystem, and our community at large. We strive to create a corporate culture that values diverse backgrounds and innovative thinking.

We have implemented Diversity, Equal Opportunity, and Inclusion action planning teams focused on analysis from diversity surveys and focus groups.

We offer a variety of training programs, such as engineering and product line management training, individual career development and coaching, training for sales and marketing and internship programs. Our training and employment opportunities aim to address both our business needs as well as employee growth.

We are committed to providing a work environment free from unlawful harassment and we prohibit all employees from engaging in harassment whether directed toward other employees or non-employees with whom we have a business, service, or professional relationship. Periodic training on our code of conduct and harassment policies is required.

We strive to be compliant with data privacy statutes globally. As a network security vendor, we review and apply security best practices. This includes onsite physical security of buildings and employees.

We offer an attractive and competitive mix of compensation and benefit plans to support our employees and their families’ physical, mental, and financial well-being. We believe that we employ a fair and merit-based total compensation system for our employees. Employees are generally eligible for medical, dental, vision, wellness and other comprehensive benefits, most of which become effective on their start date.

Almost all employees have an opportunity to acquire an ownership interest in our Company, and there are several programs that provide employees with the ability to own our stock. Generally, more than 90% of our employees participates in at least one of our stock programs, which almost all employees can participate in. Our discounted stock purchase program helps to build an employee ownership and inclusion mentality.

A10 supports the United Nations Global Compact and the protection of internationally proclaimed human rightrights and labor standards. As such, A10:

| ○ | Strictly prohibits human trafficking and child labor; |

| ○ | Provides compensation fairly and in accordance with local |

| ○ | Expects workloads and workdays to be reasonable and in compliance with local |

11

| ○ | Will not allow harsh or inhumane treatment of its workers; and |

| ○ | Will encourage and comport with the principles that enable working environments that are free from harassment and |

Governance

We are committed to building strong corporate governance guidelines based on best practices within our industry, changing requirements, and feedback from employees, customers, partners, vendors and shareholders.

We have an independent and diverse board comprised of members from variety of industries and backgrounds that aspires to best practice corporate governance features.

We have established standards and practices to which our board members, executives and employees are obligated to adhere, as outlined in the Code of Business Conduct and Ethics, Corporate Governance Guidelines, Executive Compensation Recoupment Policy, Conflict Minerals Supply Chain Policy, Whistleblower Policy, the Employee Handbook, and our Insider Trading Policy.

Shareholder input is important to us in designing our executive compensation philosophy and program. See “2022“2023 Say on Pay.”

Equity Compensation

Each non-employee director who first joins our board of directors will be granted an initial equity award with a value of $225,000. On the date of each annual meeting of stockholders, each continuing non-employee director will be granted an annual equity award with a value of $150,000.$200,000. However, a continuing non-employee director who, as of the date of our annual stockholder meeting, has not served as a board member for the entire 12-month period prior to the annual stockholder meeting will receive an annual award with a value that is prorated based on the number of months the director served during the prior year. The initial and annual equity awards will be granted in the form of restricted stock units, and the number of shares to be granted pursuant to such equity awards will be determined by the closing price of a share of our common stock on the New York Stock Exchange on the grant date. A non-employee director who is not continuing as a director following an annual stockholder meeting will not receive an annual equity award at such meeting.

The initial equity award will be scheduled to vest in three, equal, annual installments from the date the non-employee director joins our board of directors, subject to continued service with us through each such date. Each annual equity award will vest as to 100% of the underlying shares on the earlier of the one-year anniversary of the award’s grant date or the date of our next annual stockholder meeting, subject to continued service with us through such date.

Cash Compensation

Our board of directors approved the following annual compensation package for our non-employee directors:

| | | Annual Cash Retainer ($) | |

Annual retainer | | | |

Additional retainer for audit committee chair | | | 20,000 |

Additional retainer for audit committee member | | | 7,500 |

Additional retainer for compensation committee chair | | | 12,000 |

Additional retainer for compensation committee member | | | 5,000 |

Additional retainer for nominating and governance committee chair | | | 7,500 |

Additional retainer for nominating and governance committee member | | | 3,500 |

Additional retainer for non-executive chairperson of the board of directors (if applicable) | | | 30,000 |

Additional retainer for independent lead director | | | 15,000 |

| During |

12

Director Compensation for 2022

The following table provides information regarding the total compensation that was paid by the Company to each of our non-employee directors in 2022.2023. None of our non-employee directors were granted option awards in 2022.2023.

Director | | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($)(1)(2) | | | Total ($) |

Tor R. Braham | | | 48,750 | | | 149,995 | | | 198,745 |

Peter Y. Chung | | | 53,000 | | | 149,995 | | | 202,995 |

Mary Dotz(3) | | | 24,121 | | | — | | | 24,121 |

Eric Singer | | | 61,250 | | | 149,995 | | | 211,245 |

Dana Wolf(4) | | | 15,575 | | | 224,992 | | | 240,567 |

Director | | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($)(1)(2) | | | Total ($) |

Tor R. Braham | | | 71,310 | | | 199,995 | | | 271,305 |

Peter Y. Chung | | | 70,143 | | | 199,995 | | | 270,138 |

Eric Singer | | | 82,143 | | | 199,995 | | | 282,138 |

Dana Wolf | | | 47,976 | | | 166,658 | | | 214,634 |

| (1) | The aggregate number of shares of our common stock subject to stock awards outstanding at December 31, |

Name | | | Aggregate Number of Stock Awards Outstanding at December 31, |

Tor R. Braham | | | |

Peter Y. Chung | | | |

Eric Singer | | | |

Dana Wolf | | |

| (2) | The amount reported in the Stock Awards column is the aggregate grant date fair value of the stock award, computed in accordance with equity compensation provisions of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. As required by the rules of the SEC, the amount shown excludes the impact of estimated forfeitures related to service-based vesting conditions. Note that the amount reported in this column does not correspond to the actual economic value that may be received by the director from the award. |

13

ELECTION OF DIRECTORS

Our board of directors is currently composed of five members. At the Annual Meeting, each of the five recommended nominees, if elected, will serve for a one-year term. Each director’s term continues until the election and qualification of his or her successor, or such director’s earlier death, resignation, or removal.

As recommended by the nominating and corporate governance committee, the board’s nominees for election to the board are the following current members of the board: Tor R. Braham, Peter Y. Chung, Eric Singer, Dhrupad Trivedi and Dana Wolf. If elected, each nominee would hold office until the annual meeting to be held in 20242025 and until their successor is elected and qualified or until their earlier death, resignation or removal. For information concerning the nominee, please see the section titled “Board of Directors and Corporate Governance.”

If you are a stockholder of record and you sign your proxy card or vote by telephone or over the Internet but do not give instructions with respect to the voting of directors, your shares will be voted “FOR” the election of the nominees listed above. Each nominee has advised us that they are willing to serve on our board of directors, if elected; however, in the event that a director nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by our board of directors to fill such vacancy. If you are a street name stockholder and you do not give voting instructions to your broker or nominee, your broker will leave your shares unvoted on this matter.

The election of each director requires a plurality vote of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon to be approved. Broker non-votes will have no effect on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

EACH OF THE NOMINEES NAMED ABOVE.

14

ADVISORY VOTE TO APPROVE COMPENSATION OF NAMED EXECUTIVE OFFICERS

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, requires us to obtain an advisory vote (non-binding) from our stockholders on the compensation of our named executive officers as disclosed pursuant to Section 14A of the Exchange Act. This proposal, commonly known as a “Say-on-Pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation as a whole. This vote is not intended to address any specific item of compensation or any specific named executive officer, but rather the overall compensation of all of our named executive officers and the philosophy, policies and practices described in this proxy statement.

The Say-on-Pay vote is advisory, and therefore is not binding on us, the compensation committee or our board of directors. However, the Say-on-Pay vote will provide information to us regarding investor sentiment about our executive compensation philosophy, policies and practices, which the compensation committee will be able to consider when determining executive compensation for the remainder of the current fiscal year and beyond. Our board of directors and our compensation committee value the opinions of our stockholders and to the extent there is any significant vote against the named executive officer compensation as disclosed in this proxy statement, we will endeavor to communicate with stockholders to better understand the concerns that influenced the vote, consider our stockholders’ concerns and the compensation committee will evaluate whether any actions are necessary to address those concerns.

We believe that the information provided in the “Executive Compensation” section of this proxy statement, and in particular the information discussed in “Executive Compensation—Compensation Discussion and Analysis” beginning on page 2620 below, demonstrates that our executive compensation program was designed appropriately and is working to ensure management’s interests are aligned with our stockholders’ interests to support long-term value creation. Accordingly, we ask our stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the stockholders approve, on an advisory basis, the compensation paid to the named executive officers, as disclosed in the proxy statement for the 20232024 Annual Meeting pursuant to Item 402 of Regulation S-K and other compensation disclosure rules of the SEC, including the compensation discussion and analysis, compensation tables and narrative discussion, and other related disclosure.”

The approval, on an advisory and non-binding basis, of the compensation of our named executive officers as described in this proxy statement requires the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on this proposal. Abstentions are considered as a vote “against” the proposal because an abstention represents a share entitled to vote on this proposal. Broker non-votes will have no effect on the outcome of this proposal. You may vote “for,” “against” or abstain” on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DESCRIBED IN THIS

PROXY STATEMENT.

15

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The audit committee of the board of directors has appointed ArmaninoGrant Thornton LLP (“Armanino”Grant Thornton”), an independent registered public accounting firm, to audit our consolidated financial statements for our fiscal year ending December 31, 2023. Armanino2024. Grant Thornton has served as our independent registered public accounting firm since September 2019 and audited our consolidated financial statements for our fiscal year ended December 31, 2019, 2020, 2021 and 2022.June 2023. Representatives of ArmaninoGrant Thornton will be present at the Annual Meeting, and they will have an opportunity to make a statement and will be available to respond to appropriate questions from our stockholders.

At the Annual Meeting, our stockholders are being asked to ratify the appointment of ArmaninoGrant Thornton as our independent registered public accounting firm for our fiscal year ending December 31, 2023.2024. The audit committee is submitting the appointment of ArmaninoGrant Thornton to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. If our stockholders do not ratify the appointment of Armanino,Grant Thornton, our board of directors may reconsider the appointment.

Notwithstanding the appointment of ArmaninoGrant Thornton and even if our stockholders ratify the appointment, the audit committee, in its discretion, may appoint another independent registered public accounting firm at any time during our fiscal year if the audit committee believes that such a change would be in the best interests of the Company and its stockholders.

During our fiscal years ended December 31, 2021 and 2022, Armanino LLP (“Armanino”) served as our independent registered public accounting firm. Representatives of Armanino are not expected to be present at the Annual Meeting.

As described in the Company’s Current Report on Form 8-K filed with the SEC on June 14, 2023 (the “8-K”), the audit committee approved the dismissal of Armanino as our independent registered public accounting firm and engaged Grant Thornton to serve in this role on June 8, 2023.

The audit reports of Armanino on the consolidated financial statements of the Company for each of our two most recent fiscal years ended December 31, 2022 and 2021 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During our two most recent fiscal years and subsequent interim period from January 1, 2023 to June 8, 2023, (i) there were no disagreements with Armanino on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures that, if not resolved to Armanino’s satisfaction, would have caused Armanino to make reference to the subject matter of such disagreements in their reports on the Company’s consolidated financial statements for such years, and (ii) there were no “reportable events” as defined in Item 304(a)(1)(v) of Regulation S-K, except as described below.

The Company provided Armanino with a copy of the disclosures it made in the 8-K and requested that Armanino furnish the Company with a letter addressed to the SEC stating whether or not Armanino agrees with the statements made therein. A copy of Armanino’s letter was filed as Exhibit 16.1 to the 8-K.

During our two most recent fiscal years ended December 31, 2022 and 2021 and subsequent interim period from January 1, 2023 to June 8, 2023, neither the Company nor anyone on its behalf consulted Grant Thornton regarding (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and neither a written report nor oral advice was provided to the Company that Grant Thornton concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (ii) any matter that was either the subject of a “disagreement,” as that term is defined in Item 304(a)(1)(iv) of Regulation S-K, or a “reportable event,” as that term is defined in Item 304(a)(1)(v) of Regulation S-K.

16

The following table presents fees for professional audit services and other services rendered to the Company by Armanino for our fiscal year ended December 31, 20222023 and 2021.December 31, 2022.

| | | 2022 | | | 2021_ | |

Audit Fees(1) | | | $1,049,500 | | | $806,950 |

Audit-Related Fees(2) | | | — | | | — |

Tax Fees(3) | | | — | | | — |

All Other Fees(4) | | | — | | | — |

Total Fees | | | $1,049,500 | | | $806,950 |

| | | 2023 | | | 2022 | |

Audit Fees(1) | | | $663,875 | | | $1,049,500 |

Audit-Related Fees(2) | | | — | | | — |

Tax Fees(3) | | | — | | | — |

All Other Fees(4) | | | — | | | — |

Total Fees | | | $663,875 | | | $1,049,500 |

The following table presents fees for professional audit services and other services rendered to the Company by Grant Thornton for our fiscal year ended December 31, 2023.

| | | 2023 | |

Audit Fees(1) | | | $1,120,000 |

Audit-Related Fees(2) | | | — |

Tax Fees(3) | | | — |

All Other Fees(4) | | | — |

Total Fees | | | $1,120,000 |

| (1) | Audit Fees consist of professional services rendered in connection with the audit of our annual consolidated financial statements, including audited financial statements presented in our Annual Report on Form 10-K, quarterly reports on Form 10-Q, and services that are normally provided by the independent registered public accountants in connection with statutory and regulatory filings or engagements for those fiscal years. |

| (2) | Audit-Related Fees consist of fees for professional services for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.” These services include accounting consultations concerning financial accounting and reporting standards. |

| (3) | Tax Fees consist of fees for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding federal, state and international tax compliance. |

| (4) | All Other Fees consist of permitted services other than those that meet the criteria above. |

In our fiscal year ended December 31, 2022,2023, there were no other professional services provided by Armanino,Grant Thornton, other than those listed above, that would have required the audit committee to consider their compatibility with maintaining the independence of Armanino.Grant Thornton.

Audit Committee Policy on Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The audit committee has established a policy governing our use of the services of our independent registered public accounting firm. Under the policy, the audit committee is required to pre-approve all audit and non-audit services performed by our independent registered public accounting firm in order to ensure that the provision of such services does not impair the public accountants’ independence. All fees paid to ArmaninoAmanino for our fiscal year ended December 31, 2022 and 2021December 31, 2023 were pre-approved by the audit committee. All fees paid to Grant Thornton for our fiscal year ended December 31, 2023 were pre-approved by the audit committee.

The ratification of the appointment of ArmaninoGrant Thornton requires the affirmative vote of a majority of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon. Abstentions will have the effect of a vote AGAINST the proposal and broker non-votes will have no effect.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF

THE APPOINTMENT OF ARMANINOGRANT THORNTON LLP.

17

| | | 2022 | | | 2021 | | | 2020 | | | Average | |

(a) RSUs granted(1) | | | 1,230,180 | | | 1,341,191 | | | 1,133,946 | | | 1,235,106 |

(b) PSUs granted(1) | | | 314,538 | | | 352,293 | | | 884,299 | | | 517,043 |

(c) Shares underlying options granted(1) | | | 0 | | | 0 | | | 0 | | | 0 |

(d) Net increase in diluted shares due to equity awards (a+b+c)(1) | | | 1,544,718 | | | 1,693,484 | | | 2,018,245 | | | 1,752,149 |

(e) Weighted-average basic shares outstanding | | | 75,528,000 | | | 77,046,000 | | | 77,776,000 | | | 76,783,333 |

(f) Burn rate (d/e)(2) | | | 2.05% | | | 2.20% | | | 2.59% | | | 2.28% |

The audit committee is a committee of the board of directors comprised solely of independent directors as required by the listing standards of the New York Stock Exchange and rules and regulations of the SEC. The audit committee operates under a written charter approved by the board of directors, which is available on our website at http:https://investors.a10networks.com.investors.a10networks.com/. The composition of the audit committee, the attributes of its members and the responsibilities of the audit committee, as reflected in its charter, are intended to be in accordance with applicable requirements for corporate audit committees. The audit committee reviews and assesses the adequacy of its charter and the audit committee’s performance on an annual basis.

With respect to our financial reporting process, our management is responsible for (1) establishing and maintaining internal controls and (2) preparing our consolidated financial statements. Our independent registered public accounting firm is responsible for auditing these financial statements. It is the responsibility of the audit committee to oversee these activities. It is not the responsibility of the audit committee to prepare our financial statements. These are the fundamental responsibilities of management. In the performance of its oversight function, the audit committee has:

reviewed and discussed the audited financial statements with management and Armanino;Grant Thornton;

discussed with ArmaninoGrant Thornton the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board; and

received the written disclosures and the letter from ArmaninoGrant Thornton required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has

discussed with ArmaninoGrant Thornton its independence.

Based on the audit committee’s review and discussions with management and Armanino,Grant Thornton, the audit committee recommended to the board of directors that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 20222023 for filing with the Securities and Exchange Commission.

Respectfully submitted by the members of the audit committee of the board of directors:

Tor R. Braham (Chair)

Peter Y. Chung

Eric Singer

This report of the audit committee is required by the SEC and, in accordance with the SEC’s rules, will not be deemed to be part of or incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended (“Securities Act”), or under the Exchange Act, except to the extent that we specifically incorporate this information by reference, and will not otherwise be deemed “soliciting material” or “filed” under either the Securities Act or the Exchange Act.

The following table identifies certain information about our executive officers as of March 15, 2023.27, 2024. Officers are elected by our board of directors to hold office until their successors are elected and qualified. There are no family relationships among any of our directors or executive officers.

Name | | | Age | | | Position |

Dhrupad Trivedi | | | | | President, Chief Executive Officer and Chairperson | |

Brian | | | | | Chief Financial Officer | |

| | | | | Executive Vice President, Worldwide Sales and Marketing | ||

Scott Weber | | | | | General Counsel |

Dhrupad Trivedi is also a director of our company. Please see the section titled “Board of Directors and Corporate Governance” for his background and experience.

Brian Becker has served as our Chief Financial Officer since February 2021. He was appointed Interim Chief Financial Officer in September 2020 and served as Vice President and Corporate Controller from January 2018 until such appointment. Prior to joining our company, Mr. Becker served as Vice President, Accounting and Corporate Controller for YuMe, Inc., a provider of brand video advertising software and audience data, from June 2014 to December 2017, and as Director, Revenue and Cost Accounting, from August 2013 to June 2014. He also served in various roles within Revenue Accounting at Symantec Corporation, a cybersecurity software and services company, from 2010 through 2012. Mr. Becker began his career in public accounting at Ernst & Young, LLP in San Jose, California. Mr. Becker is a certified public accountant licensed by the California Board of Accountancy and holds a B.A. in Business Economics from the University of California, Santa Barbara.

Scott Weber joined A10 Networkshas served as our General Counsel Chief Risk Compliance Officer and Corporate Secretary insince June 2022. Mr. Weber has over thirty years of legal experience, most recently with Workday, Inc. (Nasdaq: WDAY) where he spent three years managing a dedicated commercial legal team in support of the North America large sales organization and Workday’s global contracts operations team. Prior to Workday, Mr. Weber served as Lumina Networks Inc.’s General Counsel in San Jose, Calif. after relocating from Singapore where he had spent 10 years leading Juniper Network, Inc.’s (NYSE: JNPR) Asian Legal department. His work at A10 includes oversight of A10’s legal and corporate compliance-related activities. Mr. Weber has a JDJ.D. in law from Southern Methodist University and a BAB.A. from Emory University.

This Compensation Discussion and Analysis provides an overview of the material components of our executive compensation program. The following persons are collectively referred to in this Compensation Discussion and Analysis and the accompanying compensation tables as our Named Executive Officers (“NEOs”):

Name | | | Position |

Dhrupad Trivedi | | | President and Chief Executive Officer |

Brian Becker | | | Chief Financial Officer |

| | | Executive Vice President, Worldwide Sales and Marketing | |

Scott Weber | | | General Counsel |

| | | Former Executive Vice President, |

| (1) |

| (2) | Mr. |

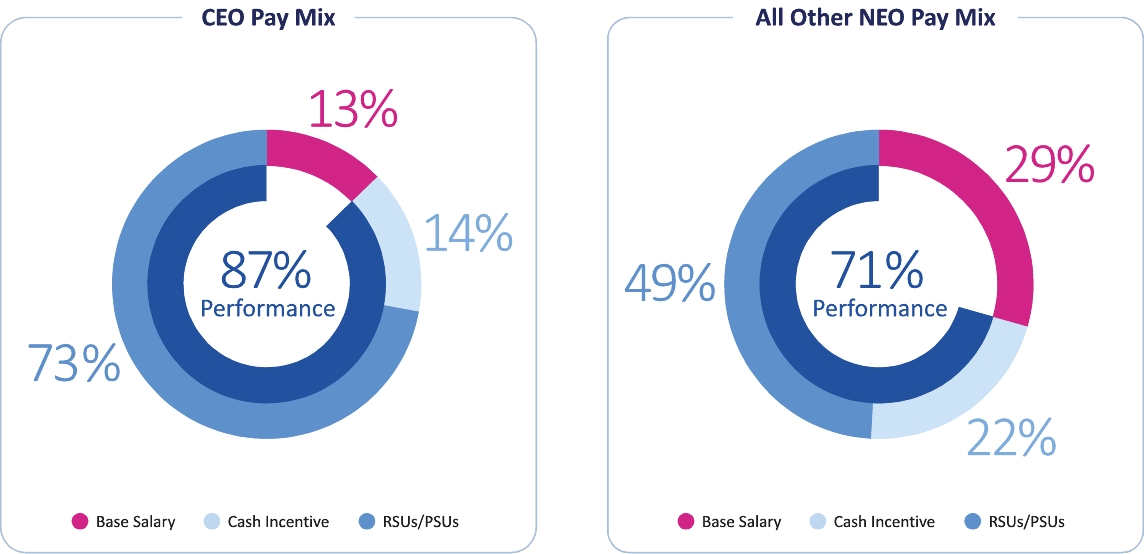

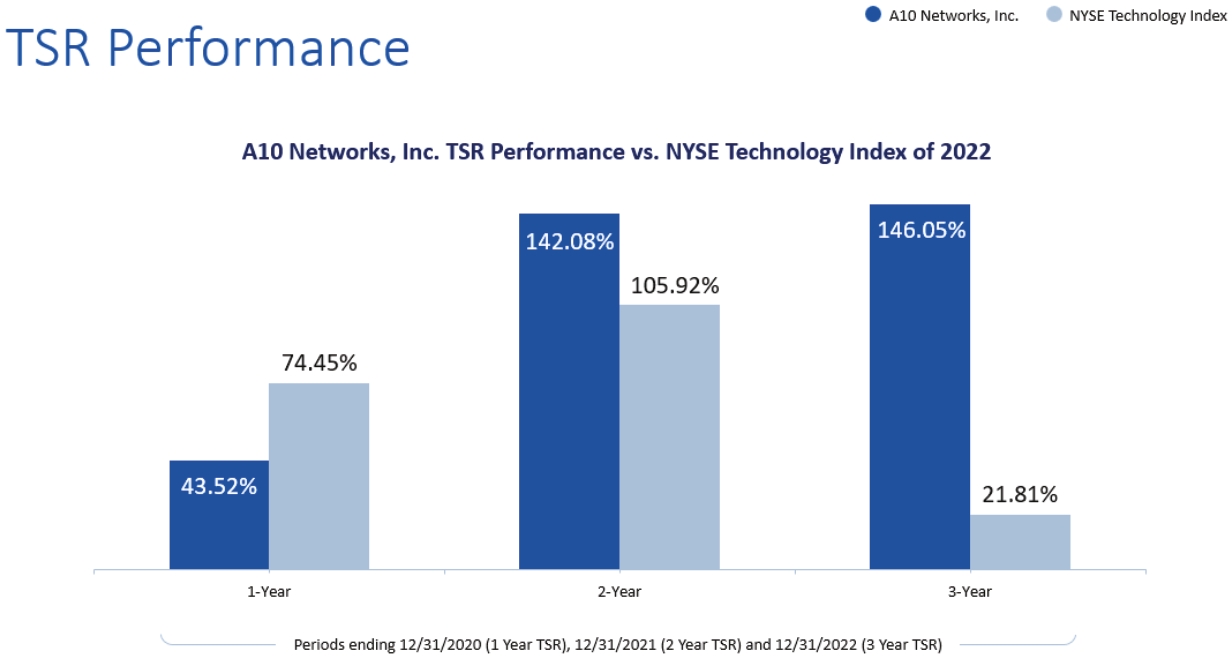

Our products and services address securitycybersecurity and infrastructure technology requirements. Increasingly,Despite the dual impacts of rising inflation and interest rates, A10 Networks, Inc.has continued to deliver solid execution and our diversified business model helps us navigate these challenging periods better than peer companies. We are focused on growing our cybersecurity share of investment and have increased R&D in new and enhanced security solutions. In addition, A10 is positioned asin a diversified, differentiated security solutions provider, structuredstrong position to mitigate fluctuations from any single customer or region. While we are not immune from recessionary impacts,grow our industry leadership makes our offerings a priority over discretionary investments. We remain well-positioned for continued success with both enterprise and service provider customers. In 2022 we successfully navigated supply chain constraints, maintained robust gross margins and effectively managed our operating expenses, which drove profitability and free cash flow. We have rapidly adapted to fluctuationsshare of wallet in the macroeconomicenterprise segment and maintain leadership with service providers, helping them to secure and expand broadband services to underserved communities. In 2023, we acted quickly to adapt to the changing environment, allocate resources and A10 Networks, Inc. continuesapply them to be focused on consistent organic growth, increasing profitability,the most strategic opportunities for growth. We continued to drive operating efficiencies, reducing our cost structure and building long-term value.maintaining profitability. Our executive compensation philosophy is focused on real pay delivery through revenue and operating margin growth that drives total shareholder return (“TSR”) and aligns employees with customers and stockholders.

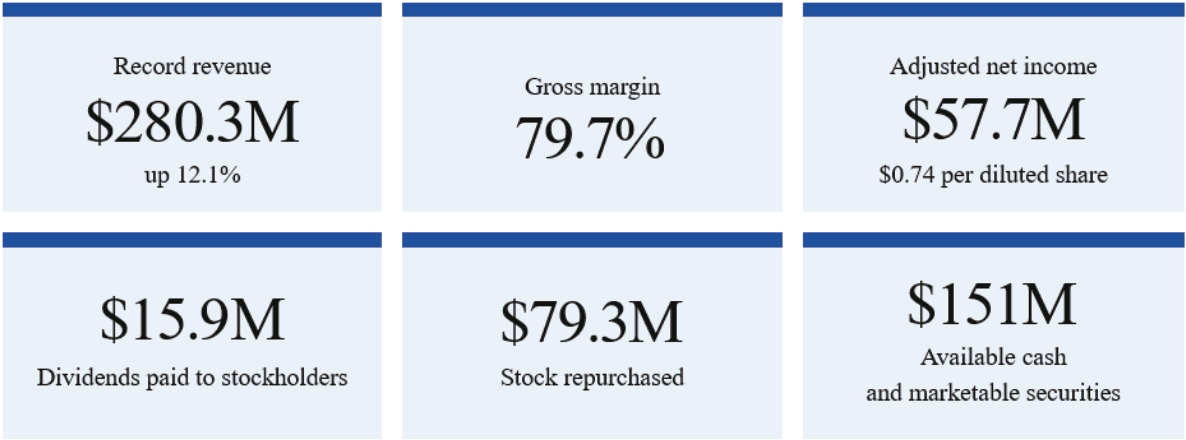

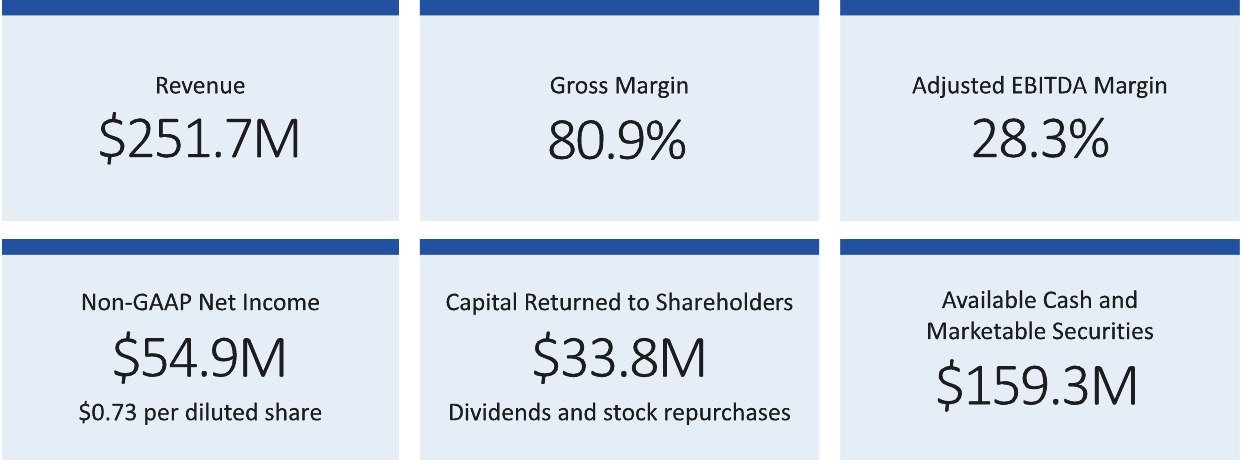

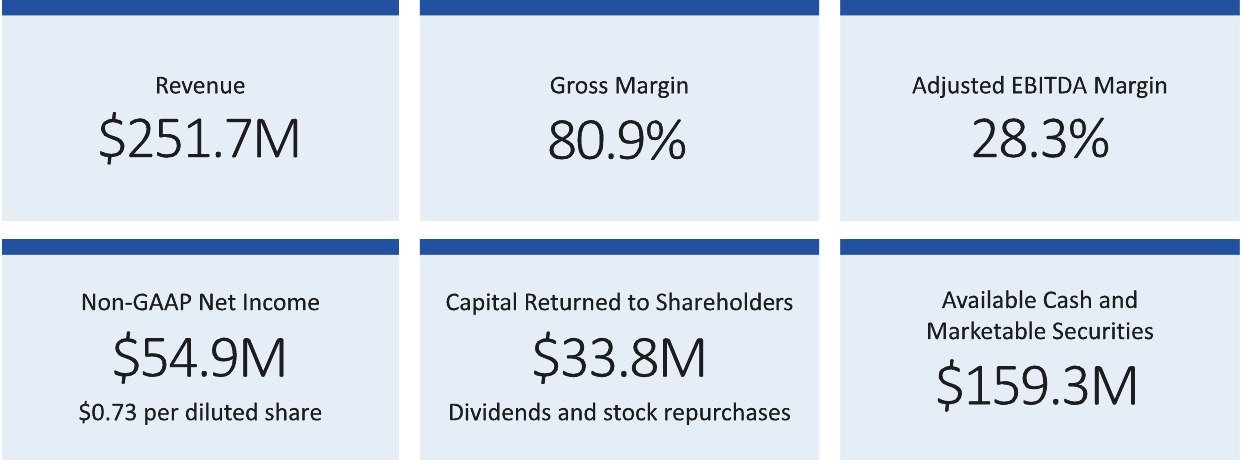

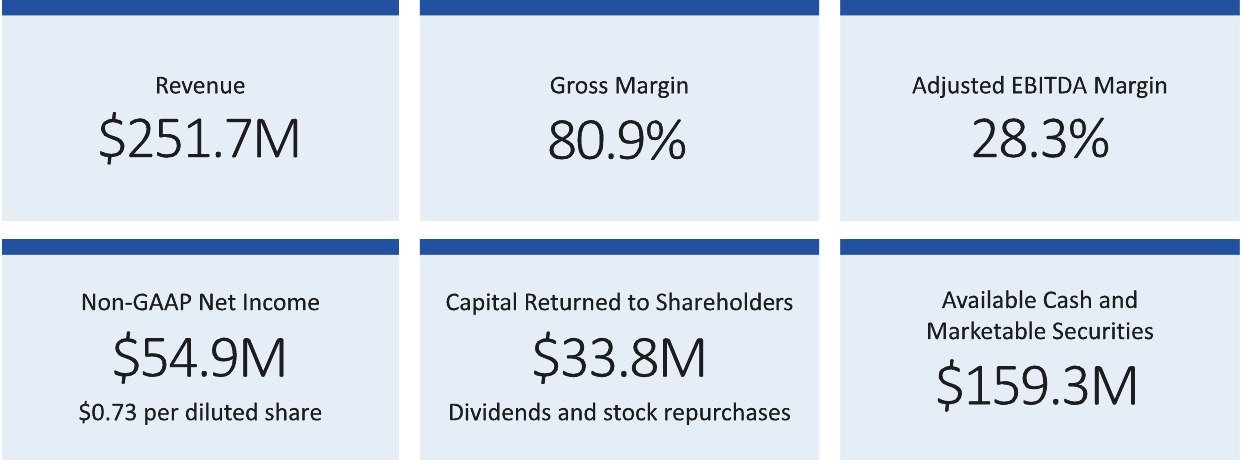

Financial Summary and Compensation Highlights

Our 20222023 fiscal year revenue was $280.3$251.7 million, (up 12.1% from last year),down $28.6 million (10.2%) year-over-year, which exceededdid not meet the minimum target threshold of the revenue portion of our corporate performance goals under our 20222023 Executive Cash Incentive Plan. As a result, no bonuses were earned at 122% based on the revenue portion of our corporate performance, which accounts for 70%50% of the payout under the 20222023 Executive Cash Incentive Plan.

Our 20222023 fiscal year adjusted EBITDA margin was $75.1 million (representing 26.8%28.3% of revenue, in line with stated goals for profitability), which exceededdid not meet the minimum threshold corporate performance goals under our 20222023 Executive Cash Incentive Plan. As a result, no bonuses were earned at 97% based on the adjusted EBITDA portion of our corporate performance, which accounts for 30%50% of the payout under the 20222023 Executive Cash Incentive Plan.

Our one-year, two-year, three-year and three-yearfour-year absolute TSR are 44%, 142%, 146% and 146%98%, respectively.

Based on the foregoing, we believe our increase in NEO compensation for 2023 is in line with our improved financial and stock performance.

At our 20222023 Annual Meeting, stockholders voted strongly in support of our executive compensation program with approximately 99%100% of votes cast in support of the Company’s say-on-pay proposal. We continue to engage our stockholders on various issues through an extensive and thoughtful investor relations program. During this engagement, stockholders have an opportunity to provide feedback on a variety of topics, including executive compensation. The Company’s outreach via investor conferences and other means has increased and we have received strong favorable support from our stockholders over the past few years. The compensation committee considers stockholders’ viewpoints in the development and approval of all compensation policies and practices at A10 Networks, Inc.

Compensation Practices

We are committed to sound executive compensation policies and practices, as highlighted in the following table.

| | | What We Do | | | | | What We Don’t Do | ||

✔ | | | Heavy emphasis on at-risk | | | ✘ | | | Prohibition of hedging, pledging, and short |

✔ | | | Double-trigger and retention-oriented change in control | | | ✘ | | | No retirement |

✔ | | | Annual compensation risk assessment. Our compensation committee conducts an annual risk assessment of our compensation program. | | | ✘ | | | No pension or other special |

✔ | | | Clawback policy. We maintain a clawback policy that applies to all of our NEOs. | | | ✘ | | | No change in control gross-up payments. We do not offer gross-up payments for related change of control excise taxes. |

✔ | | | Independent compensation | | | ✘ | | | No |

✔ | | | At-will | | | ✘ | | | No |

Compensation Philosophy

Our executive compensation program is designed to attract and retain the best available personnel for positions of substantial responsibility, provide incentives for such persons to perform to the best of their abilities, and to reward our NEOs and other corporate officers for achieving strong operational performance and delivering on theour Company’s strategic initiatives, both of which are important to the long-term success of the Company. Our philosophy is underpinned by the following key principles:

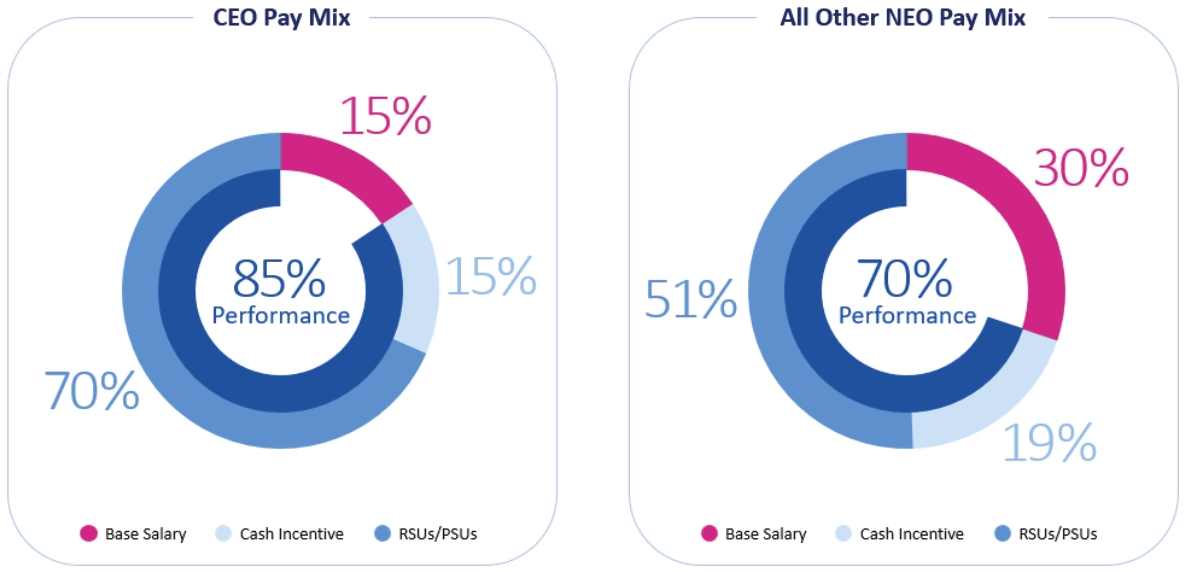

Performance-Driven and Stockholder-Aligned | | | A significant portion of our NEOs’ total compensation should be variable (“at-risk”) and linked to the achievement of specific short- and long-term performance objectives and designed to drive stockholder value creation. |

| | | ||

Competitively-Positioned | | | Target Total Direct Compensation |

| | | ||